Double Entry for Dividend

What Is the Purpose of a Journal Entry. The list represents.

Calculating Dividends Recording Journal Entries Youtube

Entry and reversal deals use the Take Profit values from the original order based on which the position.

. The ETFs main purpose is conviction. Here are the double entry accounting entries associated with a variety of business transactions. At the date of declaration the business now has a liability to the shareholders to be settled at a later date.

The Vanguard High Dividend Yield ETF is a special purpose vehicle that groups North American high dividend-paying stocks. Relief from Double Taxation. 30 Founded in 1895 South Africa-based DRDGold DRD 1172 is a mining company that focuses on gold tailings businesses in the regionTailings are.

This is an interesting fact that although they. The credit entry to dividends payable represents a balance sheet liability. Exit deals use the Stop Loss of a position as at the time of position closing.

Theres no dearth of financial literature suggesting that high. Technically you can consider the below as the best TSX dividend stocks now for an entry point. At the same time as the dividend is declared the business will have decided on the date the dividend will be paid the dividend payment date.

When a corporation earns a profit or surplus it is able to pay a proportion of the profit as a dividend to shareholders. It describes the drop of a stock or index a rebound another drop to. My approach is simple but you need key data that I have cultivated with the Dividend Snapshot Screeners.

Closing journal entries Dividend account. In this case. Double entry bookkeeping Double Entry Bookkeeping Double Entry Accounting System is an accounting approach which states that each every business transaction is recorded in at least 2 accounts ie a Debit a Credit.

Understanding Double Tax Avoidance Agreement DTAA with Case Laws. Stock splits are events that increase the number of shares outstanding and reduce the par or stated value per share. A dividend is a distribution of profits by a corporation to its shareholders.

10 billion Dividend yield. Existing shareholders would see their shareholdings double in quantity but there would be no change in the proportional ownership. This rate will be increased to 20 in the absence of PAN submission by the recipient of dividend income.

Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on income and Capital and to Certain Other Taxes together with a related Protocol signed at Bonn on August 29 1989. Article 32-----Entry into Force Article 33-----Termination. Get Ready once again its time to Double Your Dividend and you can win with the KSRM Radio Group.

In fact the need for any bonds is often. Many excellent companies simply havent been paying dividends or havent been publicly traded. To determine the accounting treatment of preference shares and dividend on such shares first you have to identify if preference shares are redeemable or irredeemable.

As per this section 10 TDS is applicable for dividend income above Rs5000 for an individual. CAGR on dividends was 82 and because dividend growth drives price growth Jonathan price CAGR was 86 from 2009 to 2019. The double-entry system has two equal and corresponding sides known as debit and credit.

The Dividend Aristocrats arent the only place to look. The entry box will be at sponsor stores each day starting at 10am. Furthermore the number of transactions entered as the debits must be equivalent to that of the credits.

The entry is a debit to the inventory asset account and a credit to the cash asset account. Thats a consistent return which means using the rule of 72 I double my portfolio every 6 years. Four more of the best dividend stocks to buy.

A double bottom is a charting pattern used in technical analysis. Dividend received from a foreign company gets taxed both in India and in the home country of the foreign company. Dividend stocks and risk aversion.

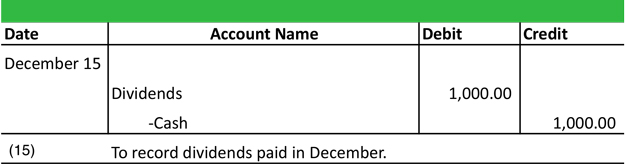

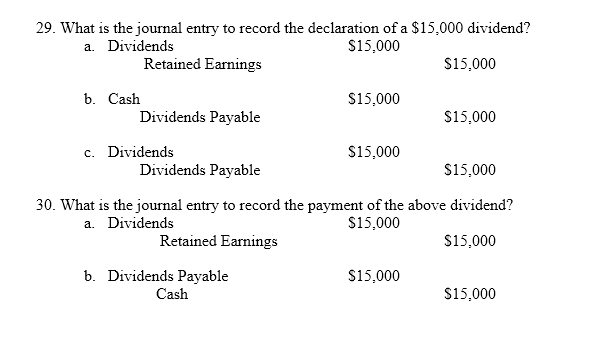

Any amount not distributed is taken to be re-invested in the business called retained earningsThe current year profit as well as the retained earnings of previous years are. Used in a double-entry accounting system journal entries require both a debit and a credit to complete each entry. To do so the parent company enters a debit to the dividends receivable account and a credit to the investment in subsidiary account on the business day after the record date.

After the closing journal entry the balance on the dividend account is zero and the retained. With dividend growth a companys yield grows over time and enhances retirement income. No other investment services provide you.

A journal is a record of transactions listed as they occur that shows the specific accounts affected by the transaction. UnitedHealth Groups 12 dividend yield is below the SP 500 indexs 16 yield. If a US Company pays a dividend to an Indian Resident shareholder then the dividend income will be liable to tax in India.

A dividend is more like a bonus that comes to you in the form of cash or more shares in the companys stock. Now heres the bonusthe double double Tim Horton and I both went to St. High dividend growth is poised to persist.

So when you buy goods it increases both the inventory as well as. Further USA Company paying the dividend also has a. Double-entry bookkeeping also known as double-entry accounting is a method of bookkeeping that relies on a two-sided accounting entry to maintain financial information.

For example a 2-for-1 stock split would double the number of shares outstanding and halve the par value per share. Dividend paid by a resident company of a contracting state to a resident of the other contracting state may be taxed in that other state. Examples of Double Entry Accounting.

The fund is managed passively and provides a lucrative flow-through yielding 304. In the above example the balance on the dividend account was a debit of 200 to close the dividend account the following closing entry is made. The parent company reports the effects of this transaction on its.

Entry and reversal deals use the Stop Loss values from the original order based on which the position was opened or reversed. Accounting treatment for redeemable preference shares If preference shares are redeemable then shares are reported as liability in statement of financial position. This had emerged a complex world of business along with complex world of Accounting Taxation.

You buy 1000 of goods with the intention of later selling them to a third party. In Todays modern world of advanced globalization business is not restricted to a single geographical territory crosses all border of the countries. The Convention will replace the existing convention which.

The country has a right to tax on. When the subsidiary pays a dividend the parent company reduces its investment in the subsidiary by the dividend amount. Every entry to an account requires a corresponding and opposite entry to a different account.

Listen for the location of the day Monday through Saturday on KSRM 920AM KWHQ 1001 FM KKIS 965 FM KSLD 1140AM KFSE 1069FM and KKNI 1053 FM then go and register.

Dividends Declared Journal Entry Double Entry Bookkeeping

Dividends Payable Classification And Journal Entry Debit Credit

Comments

Post a Comment